Why Senior Housing

OUR SENIOR HOUSING REAL ESTATE INVESTMENT FOCUS

Senior Housing Types:

X Independent Living

✓ Assisted Living

✓ Memory Care

✓ Skilled Nursing Facility

Current 2019 and 2020 Investment Focus:

Assisted Living, Memory Care, and Unique Skilled Nursing

Facilities:

1) Existing Properties – Undervalued cash flowing

properties with 40-50% upside potential

2) New Construction – only in primary and secondary

markets with medium to high income

demographics.

3) Value-add Properties – Where changing of

operators and excess land can be optimized.

NOT on Independent Living Alone: We believe the barrier to entry is too low, which will cause an oversupply.

In the next 3-5 years, oversupply will come primarily from 1) Underperforming Multi-family and 2) underperforming Hotels

SENIOR HOUSING OVERVIEW

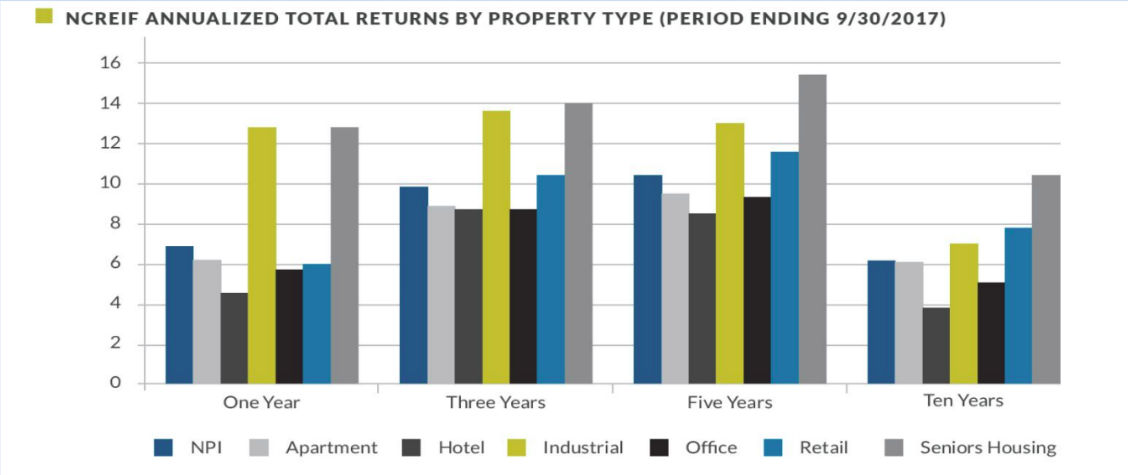

● In a year-end report by the National Investment Center the annual total returns (unlevered) through the end of Q3

2017 for seniors housing exceeded 12%

● NCREIF, the leading provider of investment performance indices for commercial real estate in the US

(www.ncreif.org), compared the leading commercial real estate sectors over the last 10 years. When compared

against other asset classes seniors housing has historically outperformed all sectors with the exception of industrial

commercial real estate during the last 12 months

● The strong performance compared to the other asset classes is based on the strong correlation of operational

dependency and the anticipation of the strong demographic support

● Given the strong historical returns, interest from institutional investors has been increasing in recent years. Publicly

listed companies and REITS were the primary buyers from 2013 to 2015, but beginning in 2016 institutional investors

as well as cross-border investment has seen strong growth

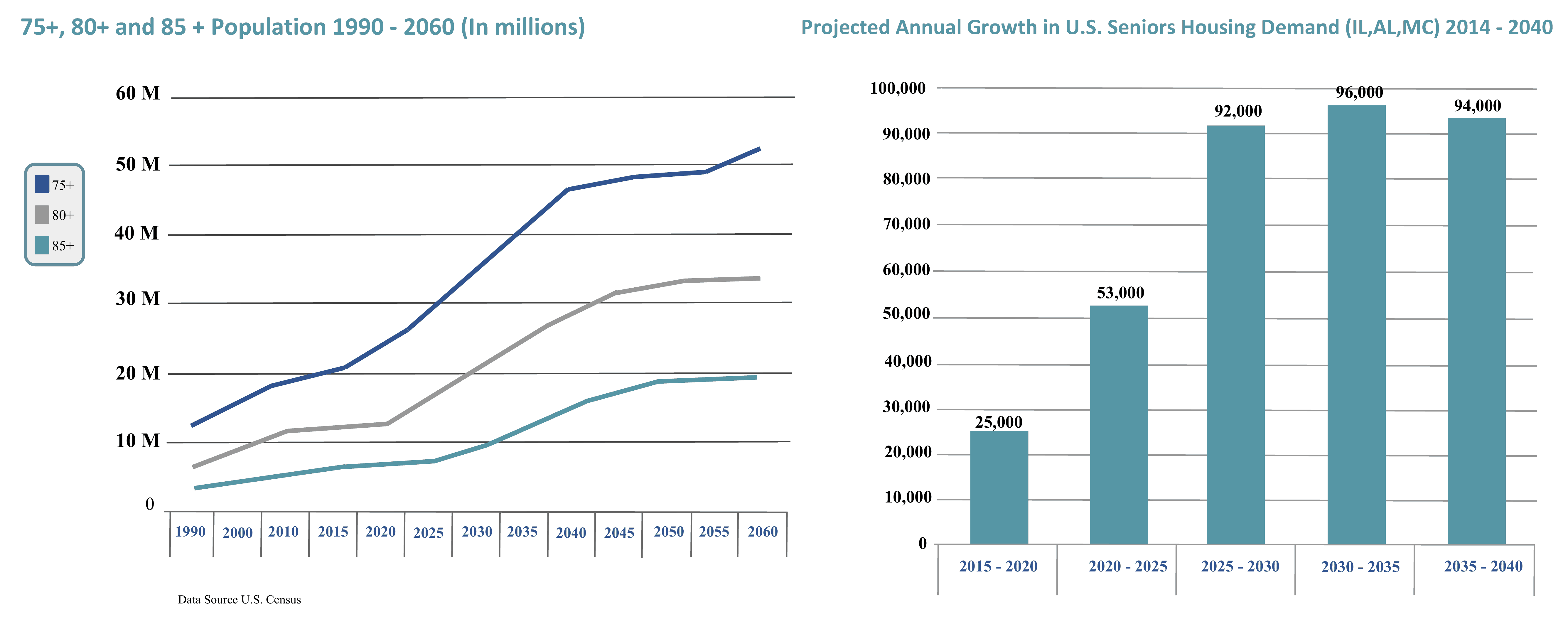

● Born between 1946 and 1964, the “Baby Boomers” are the largest retiring generation in United States history. The

first Baby Boomers reached retirement age of 65 in 2011. By 2030, more than 20% of U.S. residents are projected to be

aged 65+ compared to 13% in 2010 (9.8% in 1970)

● The number of people in oldest cohort (85+) is projected to grow from 5.9MM to 8.9MM by 2030 and 18MM by 2050.

Another driver of this growth is mortality rates. Survivorship has increased dramatically in America and according to

NCHS (“National Center for Health Statistics”) life expectancy at birth for the United States population reached a

record high of 78.8 years in 2012. Additionally, death rates for 5 of the top 10 leading causes of deaths decreased

between 2013 and 2014

● The National Investment Center (“NIC”, senior housing data agency) has projected that demand will more than

double and grow to 3.2MM units by 2040. This is an increase of 1.8MM over 2015 levels. To keep pace with this

demand growth, annual production would need to ramp up from 25,000 units per year in 2015 to 96,000 units per

year in 2030 (peak period of demand growth)

Continuum of care for Senior Housing

…Senior Housing in The United States is an operational real estate business model where the property type depends on the amount or type of care that is delivered within the facility. The amount of care that is delivered increases as you move to the right on the continuum above (often referred to as “the continuum of care”). The continuum ranges from “no care” Active Adult communities (retirement communities) to Skilled Nursing Facilities (“SNF’s”) where residents often require high levels of care for many (or all) activities of daily living (“ADL’s”). The type of revenue or pay source depends upon the property type as well. Residents typically pay privately (“private pay”) for active adult communities through CCRC’s. Skilled Nursing Facilities are typically reimbursed through Medicare or Medicaid (some private pay dollars but typically a mix depending on the type of SNF). However, states will often reimburse assisted living and memory care communities through a Medicaid program for individuals in financial need (such as the case in Washington and within this portfolio). This reimbursement amount is set by the individual state. You will often see a mix of Medicaid and private pay residents within the same community.

Another way to look at the continuum above is in terms of operational risk and “need” to leave their home and move into a senior housing facility. An assisted living resident typically needs assistance with multiple ADL’s and therefore will often struggle to live in their own home which creates higher “need” for some sort of senior housing. The time between tour to move-in tends to be shorter for these residents as opposed to an independent living resident who may be mobile and active but wants to “downsize” or increase social activity. The more “need” and care that is required at the facility means more regulatory oversight (usually state regulated) and employees required. Therefore, higher operational risks, higher cap rates, and more asset management.

One of the main keys in senior housing investing is matching an operating partner with the right product type and care level. Operators often specialize in only a few of the above categories. Very few (if any) specialize in all of them.

Invest Alongside Us

Need Further Support? Contact Us.